0

0Our Solutions

explore our solutions

our lawyers

Testimonials

We have engaged them to represent us for VC deals and have found FSLAW to be particularly detailed in their review of documents and trust their depth of knowledge.

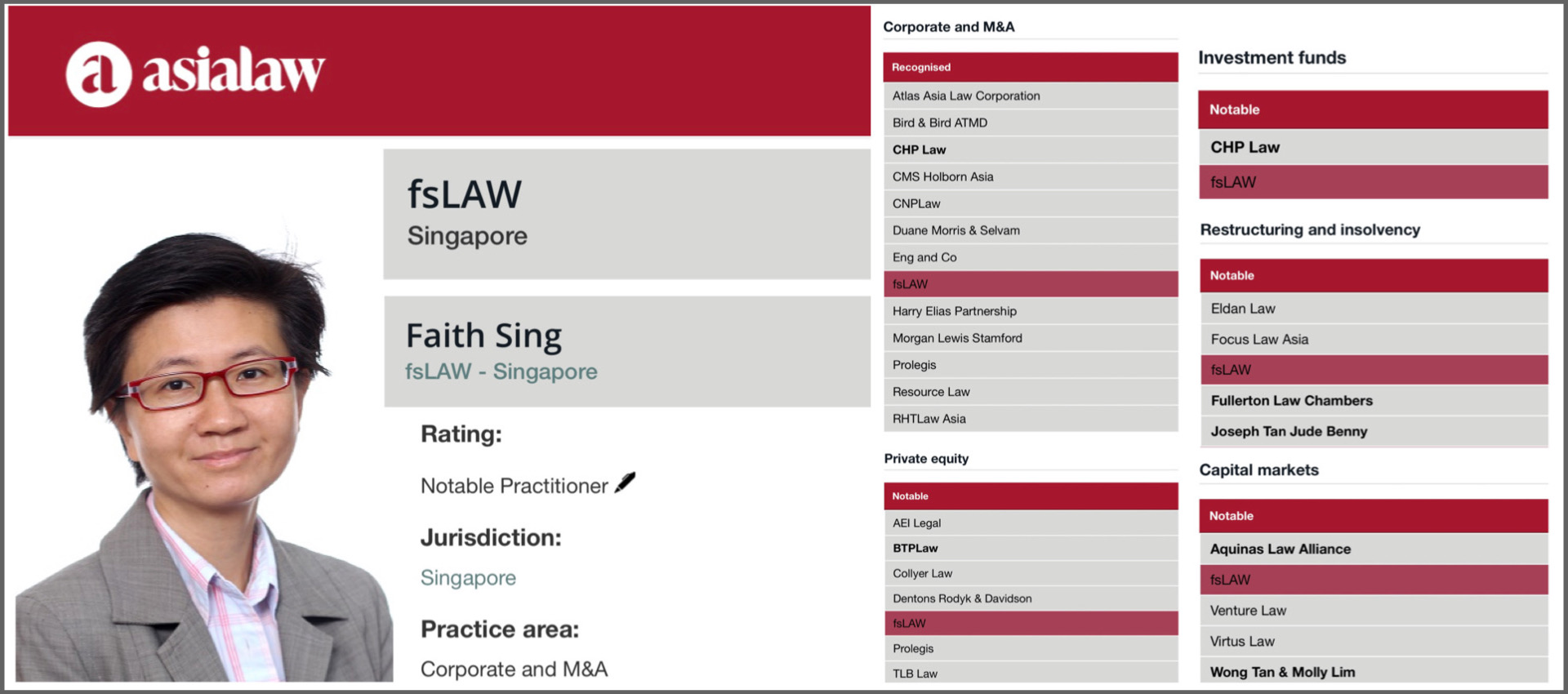

Chambers Asia-Pacific 2021 Guide

Smart, responsive and pragmatic. Client first approach. (Lack of) size can sometimes be a limitation in terms of capacity but their small size and personal attention is also a great strength.

Corporate and M&A, asialaw Profiles 2020

Excellent lawyer. Very professional, Faith is always available to answer our questions and is able to guide us successfully through diverse situations.

asialaw Profiles 2020

FSLAW provided a very high level of service, knowledgeable as to what was required, provided pragmatic support in negotiations.

Private Equity, IFLR1000 Profiles 2020

Excellent work. Commercially minded lawyers led by Faith.

Private Equity, IFLR1000 Profiles 2020

Our Awards

Chambers Asia-Pacific 2021 to 2024 Guides - Startups & Emerging Companies

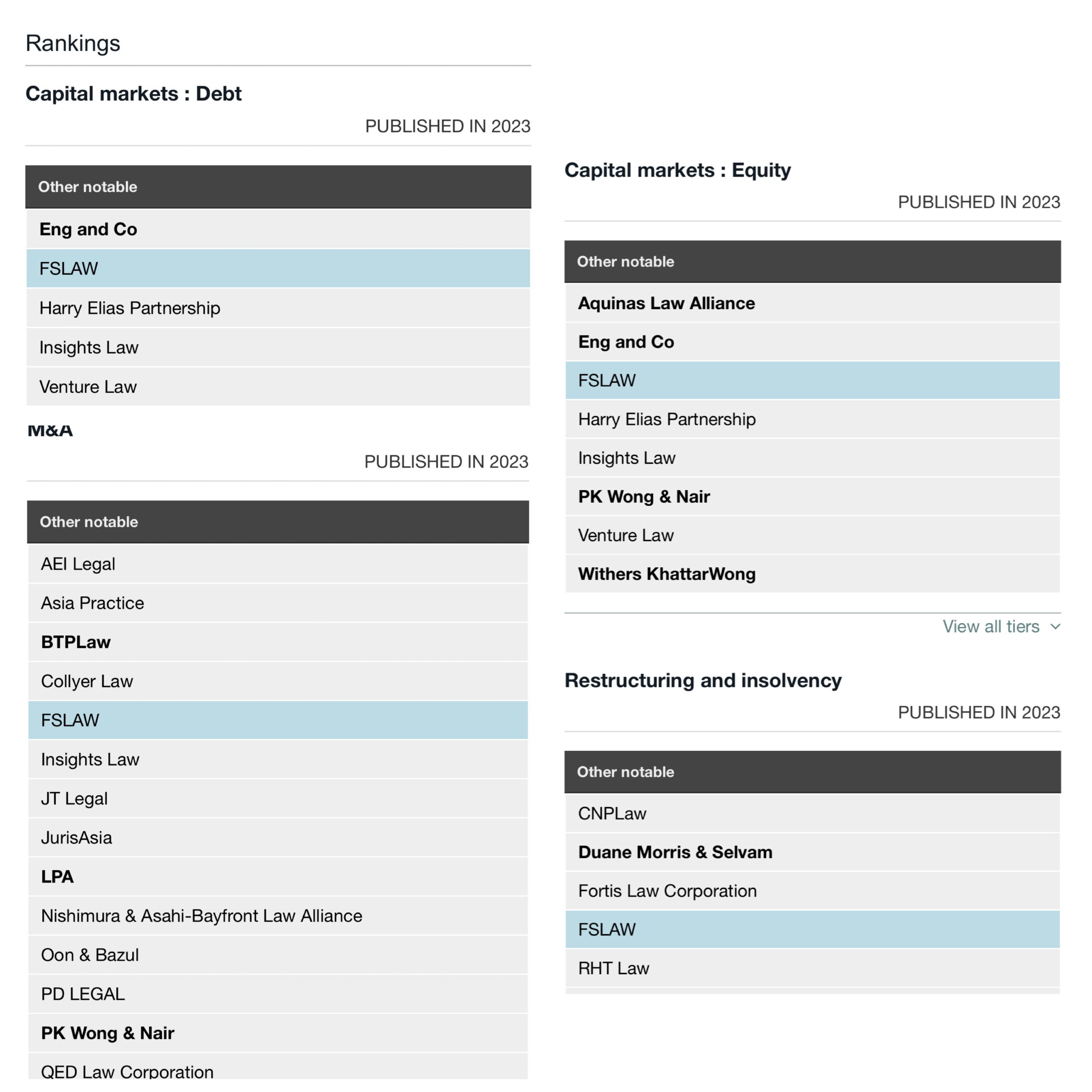

IFLR1000’s 2020 to 2024 Guides - M&A, Capital Markets (Debt and Equity), Restructuring and Insolvency

asialaw Profiles’ 2020 to 2024 Guides - Corporate & M&A, Private Equity